If you’re reading this article, chances are that you’re a “builder“; the crypto word for people testing new ideas, launching products, and paving the way towards technologic adoption.

Builders are a different breed: For starters, if you’re one of them, you might see the constant price action of crypto assets as a distraction rather than entertainment. Second (and we know the pain), you might also be familiar with the stress of constantly having to pivot to fit the needs of this space.

We’ve come a long way with every wave of blockchain adoption. From Bitcoin itself to real-world use cases, fundraising through ICOs/STOs/IDOs/whatever-Os, institutional incursion, DeFi, and everything in between, 13 years seem like a short time for our ecosystem to have snowballed and diversified so much.

And therefore, it’s easy to get lost.

They say that if you want to move quickly, you should travel on your own… but that to go fast you should move along with others. This is particularly true in our industry, which is why we’ve compiled this guide to help you identify and get together with those that can help you make the most out of your potential.

Why should I look for the best crypto advisors for my blockchain project?

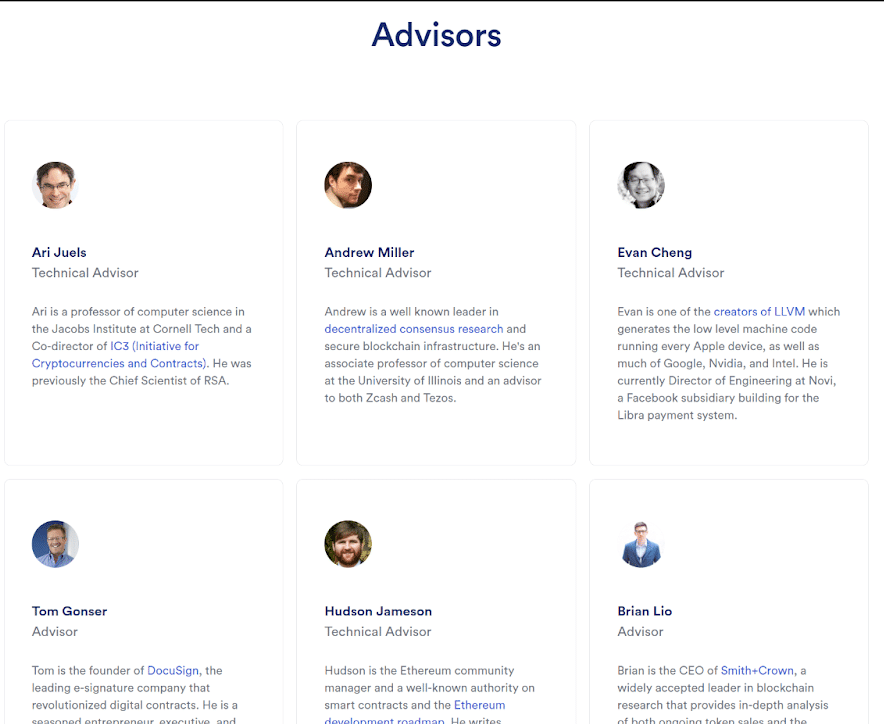

Even the most successful crypto projects (here ChainLink) proudly advertise their advisors.

Like we said before, as you develop new products, solutions, open-source software, or even educational materials, you might realize that there’s a vast, open (and a bit nerdy) space in front of you. Indeed, going nose-first into the blockchain market might seem daunting.

Therefore, it makes sense to stick with people who have gone where you want to go, know the way, and that can assess how YOU can go through it.

Please note that we refer to “hiring” advisors because we understand that, while you can build partnerships and relationships, at some point, expertise comes at a price. Blockchain consultants also vary in their areas of specialty and the degree of their knowledge. There are, nonetheless, two key reasons why you would want to tap into the insights of a third party.

1. This is a new, changing field. Staying up to date is crucial

Because we live in blockchain’s early stages, we have to live with a curious phenomenon: At all times, you have to be hyper-aware of the general crypto landscape, on top of the details of your target traditional industry.

For example, let’s say that you’re building a videogame with some blockchain and NFT features. Well, in the traditional videogame world, to make a high-quality game, you’d have to be on top of the game’s artistic design, its production, know the latest trends of the industry, etc.

However, since you’ve gone out of your way (and props for it!) to add all these cool blockchain features that people will undoubtedly love, you now need to be well-versed on blockchain choice, tokenomics, general crypto trends, and more. All of this isn’t very easy if you’re entering this world for the first time, and being a seasoned member of the crypto community is no guarantee of success either.

In our example, crypto business advisors make complete sense to focus on developing the game itself. But as you can imagine, whether you’re tokenizing a farm, launching a crypto wallet, or doing NFTs for your football team, the same might apply to you.

2. The devil’s in the details, and your advisor might likely know something that you don’t

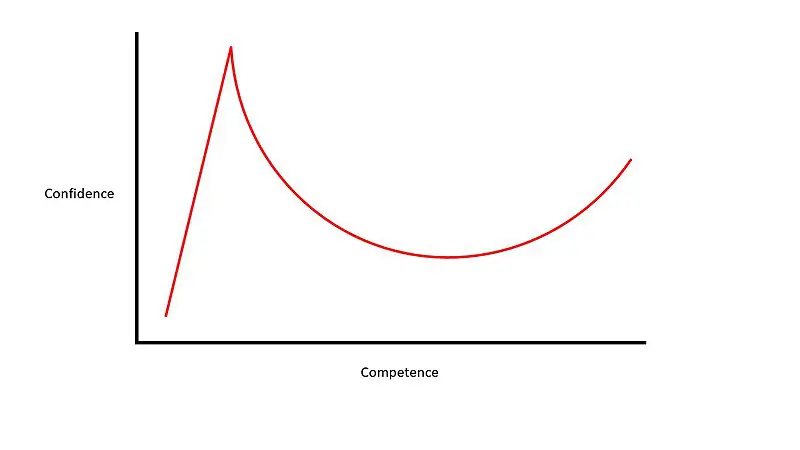

What intelligent people call the Dunning–Kruger effect is, basically, the theory that people with little ability or knowledge overestimate their competence. You don’t need to be a psychologist to recognize this: We’ve all seen it happen countless times and, while it can lead to entertaining results, we know that you likely don’t want to burn your chances of success. Particularly not because of the classic “I didn’t know that I didn’t know”.

Whether you’re targeting a project advisor, ICO or STO advisors, or someone with other kinds of expertise, we’re sure that (at the very least) a third party’s opinion cannot hurt. An expert can tell you whether your expectations are off, help you spot unthought synergies, connect you with colleagues, or point out design flaws.

Perhaps more importantly, an advisor or consultant can save you time and money and expand your vision of the world. They could do this by pointing to a friendly jurisdiction for your launch, discovering a strength you didn’t know you have, or by introducing you to a potential investor. They also could be aware of possible competitors, partners, and media opportunities that are easy to reach with their help.

3. Blockchain and cryptocurrency investors care!

The simplest reason to hire cryptocurrency advisors is that your possible investors are paying attention. As a research firm, we actively recommend investors to read on a project’s team and advisors and understand their reputation/level of investment in a project.

Ask yourself: Who am I more likely to back, a company advised by the Elon Musk of my specific industry (whether that’s coffee making to literal rockets), or a group of first-timers?

When you consider the point of view of someone with skin in the game and money on the line, it’s easy to eliminate tunnel vision around your work.

Where cryptocurrency and blockchain advisors can help

Broadly, you can break down cryptocurrency advisors into four categories, all of them with their caveats and specifics. You could even consider accommodating a consultant or advisor in each one of them, depending on your budget. When looking at these categories, it’s also helpful to think whether you’re aiming to improve on the strengths you already have or become more well-rounded.

Advisors can either:

1. Consult on business aspects (e.g., improve your business model)

An old Silicon Valley adage says that every project should have two founders: One business-oriented, one technical.

If you lack a business person within your highest-level team, you most likely would want to get this kind of advisor first. A business and financial advisor can help you work out a monetisation model, build partnerships, set up your cash flow, and even help with legal matters in fuzzy grey areas, abundant in this industry.

Another reason why you could consider a business consultant if you’re trying to raise funds and have never gone through these processes. Some people specialise in helping projects in this particular situation. In the often gut-wrenching process of trying to fit investors’ preferences, it wouldn’t hurt to have someone in your corner that has gone through it and lived to tell their story.

2. Boost your marketing and communications efforts

Marketing is closely related to business (shocking, we know!), so your business advisor might even like to play a part in this regard. However, there are reasons why you could consider getting a marketing-only advisor.

In an industry where projects often have to raise public funds, marketing is vital for your success and an area where you can’t cut corners. Some consultants might help you get your brand on-point, speak clearly and directly to your audience, and fit your products to the market’s preferences. They might also have connections in media, know journalists, podcasters, streamers, YouTubers, blogs, and all kinds of Internet figures.

Remember that marketing isn’t limited to advertising: It also encompasses the critical process of testing your product against the market, receiving and implementing real feedback, collecting user data, fine-tuning your approach, and more. If you don’t have an internal marketing team (a luxury in the highly bootstrapped world of pre-launch projects), a communications and marketing advisor can mean the world for your fundraising results.

3. Facilitate valuable connections or partnerships

We’ve seen our fair share of two types of projects:

- The ones that have the capital to pay for everything and want to eat the world; and,

- The ones that fail to understand the importance of network effects.

When going to market, a project needs to figure out how to generate wealth for itself and others. It would certainly help if you also found ways to piggyback the success of others. A partnership advisor that knows your market segment can prove invaluable in this regard.

Believe it or not, partnership advisor is a role that successful people in the blockchain development scene love to play. In an industry based around the concept of sharing, creating interoperability, and building on top of each others’ creations, connecting projects is a way to generate wealth for the whole environment. You might have already seen this play out: A single break-out, killer product, or spectacular launch can detonate growth for the entire industry and ripple into seemingly unrelated fields.

Remember that every person that enters your network doesn’t add to its value: They multiply it. Treat every partnership and collaboration as a lottery ticket, and you’ll likely get rewarded!

4. Improve your technology

Going back to Silicon Valley saying from the first item on this list, it works both ways. If you are a business-oriented founder and have a business-first-business-only team, you badly need someone to consult on your technology.

It’s not uncommon in our world to see projects outsourcing development to put together a quick Minimum-Viable-Product that they can pitch to investors. It’s also not rare to see founders that understand fundamental forces, speak fluently to the value of the technology, and have good ideas, but no understanding of what it takes to make them happen. This pitfall, of course, can create a myriad of problems to coordinate a technical team and result in monetary losses or failure.

If you have a tech-fluent team, you also likely understand the value of having third parties look into your code, conduct audits, bug hunts, etc. Tech advisors can sort this out for you if it falls in their speciality range or guide you to achieve the results that catapulted them to fame. At the very least, they can tell you about their mistakes to help you avoid them!

5. Shift you to the blockchain community mindset

Another thing that’s sadly common is to see founders that are strange to blockchain land suffering from something similar to culture shock.

The land of blockchain and cryptocurrencies has its own social norms, culture, and shared knowledge, which amount to almost a different language to those that don’t speak it. You might have the right intentions to create the right products with spectacular features and benefit many people… but if you don’t use the language the community uses, you might fall back into your chair.

As we mentioned before, the world of blockchain has strong ideals, talking points, and very particular feelings about specific subjects. Rather than a marketing strategy, speaking to the blockchain community using its native language is a must-do if you want to have a shot at starting a relationship with it. If you arrived at the promised land of crypto with no previous knowledge, an advisor will catch you up to speed. They can help you close the gap as graciously as possible and save you from committing possibly irreversible errors, such as being perceived as… (suspense music) centralised.

6. Due diligence and compliance

We hate to be repetitive, but there is no limit to how complex a crypto project can get. From financials to technology, business, marketing, and many other areas, the moving parts can overwhelm even the bravest of CEOs. For this, your project can significantly benefit from having a due diligence advisor on its tool belt.

Due diligence is particularly challenging in legal areas. Because of the fuzzy regulatory landscapes and the growing variety of options, defining the best approach can take years without a specialist. This only increases in complexity when you factor in that you have to pick a jurisdiction, appoint a legal team, follow regulations to the letter, and remain decentralized enough to continue to be attractive for retail investors (if you’re targeting them)

If you take one piece of advice from this article, let that be that you should never try to save pennies on compliance or due diligence. Like many have learned before you, even the slightest deviation from the established norms can domino into the SEC knocking on your door or shutting you down altogether.

How to get advice for your crypto business: Understanding what to look for.

When considering an advisor, whether you’re hiring them as a part of your team as consultants or striking a partnership, it’s essential to ask yourself a series of questions:

- What are the top blockchain advisors? Who, or what institutions, are successful in this regard?

- What do all the top cryptocurrency advisors all have in common?

- What’s this person’s area of expertise? Does he/she match the profile I’m looking for?

- What are their unique skills? What have they done that no one else or very few people have done?

- Do they have an extremely specific area where they can be of service to me? For example, while it’s easy to find smart contract experts if you plan to launch your project on an obscure blockchain, it’s better to find people directly linked to that technology.

- What is their track record? What projects have they worked with in the past? Do they have any scandals or reputational issues in their past that can resurface and hurt your reputation?

- Are they well-connected in the area that you’re trying to improve? Do they have followers, public profiles, are they followed by the media?

These questions are a good starting point to begin evaluating candidates. And, just as you wouldn’t hire someone that doesn’t share your company’s values, you should still consider the way an advisor could fit within your organisation.

You need to be aware that if you do your marketing right and your project ranks high in the collective minds of crypto followers, your project might end up under tremendous scrutiny. Vetting an advisors’ perceived legitimacy is key to avoiding unwanted surprises, and, of course, if they have collaborated with successful projects within the space, this can rub off on yours.

So, where can you find a blockchain and cryptocurrency advisor near me?

When asked how to find advisors for a cryptocurrency business, we often believe that the best way is to go with the choices that have benefited others in the past. Like we said before, with reputations in the line in make-or-break fundraising scenarios, you want to make the most out of the quality advice you receive and minimise the possibility of adverse outcomes.

Some ways you can do this are:

1. Checking out similar, successful projects

This method is perhaps the easiest one to spot high-quality advisors. You’re likely aware of other projects in your sphere or that you admire, which, in the blockchain scene, means they have websites and whitepapers with plenty of information. By reading about who their advisors are and their roles, you can get one step closer to finding your dream advisor. This has the added perk that their presence might boost your perceived chances of success if you collaborate with one of them.

2. LinkedIn outreach

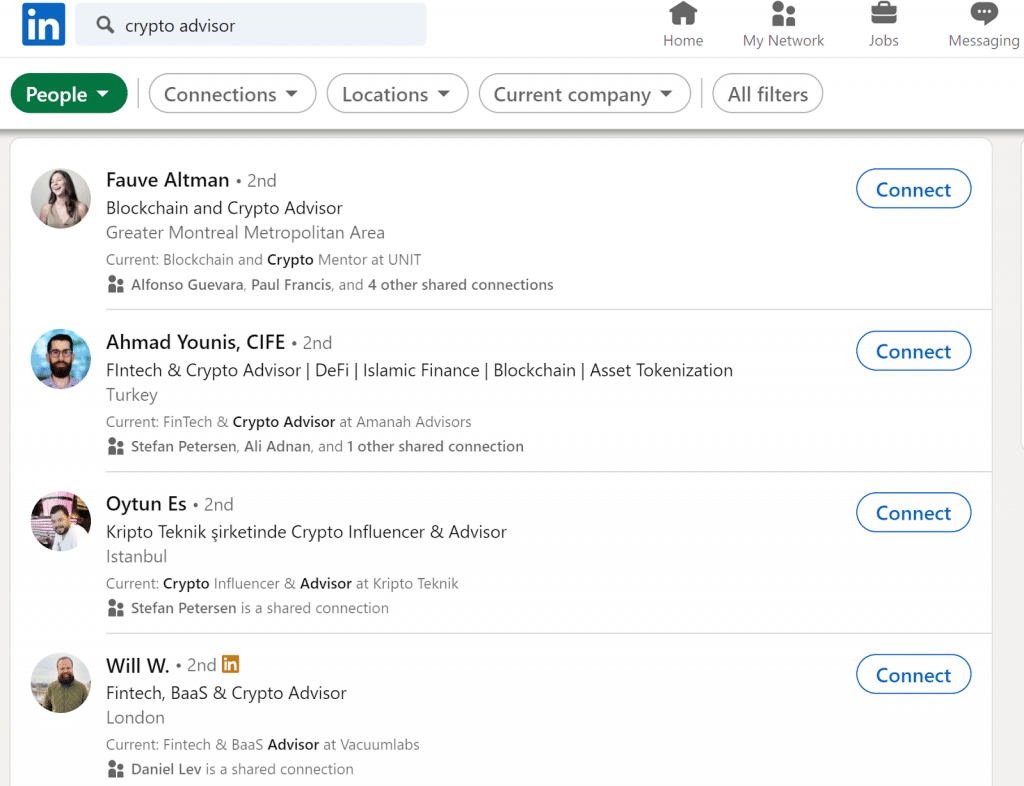

Another big win for transparency is that advisors (the legit ones, anyway) often tend to advertise their roles on their LinkedIn profiles. This is also an excellent way to figure out who will publicly talk and promote your project on their social media and to their network. When searching on LinkedIn, you can also use various filters, which should help make the process a lot easier.

3. Crypto advisor services

You can take advantage of companies that offer services to fulfill a role similar to an advisor’s. In this case, you can choose whether you want them to provide a general-scope service (improving your whole project) or to work on one particular area. Other agencies or providers might also focus on fundraising and crowdsourcing, which can be an interesting path for you if you’re looking to do a successful ICO, IDO, IEO, etc. When researching such a company, this guide should be equally valuable, as the underlying principles remain the same.

Leveraging D-CORE to understand your strengths and weaknesses.

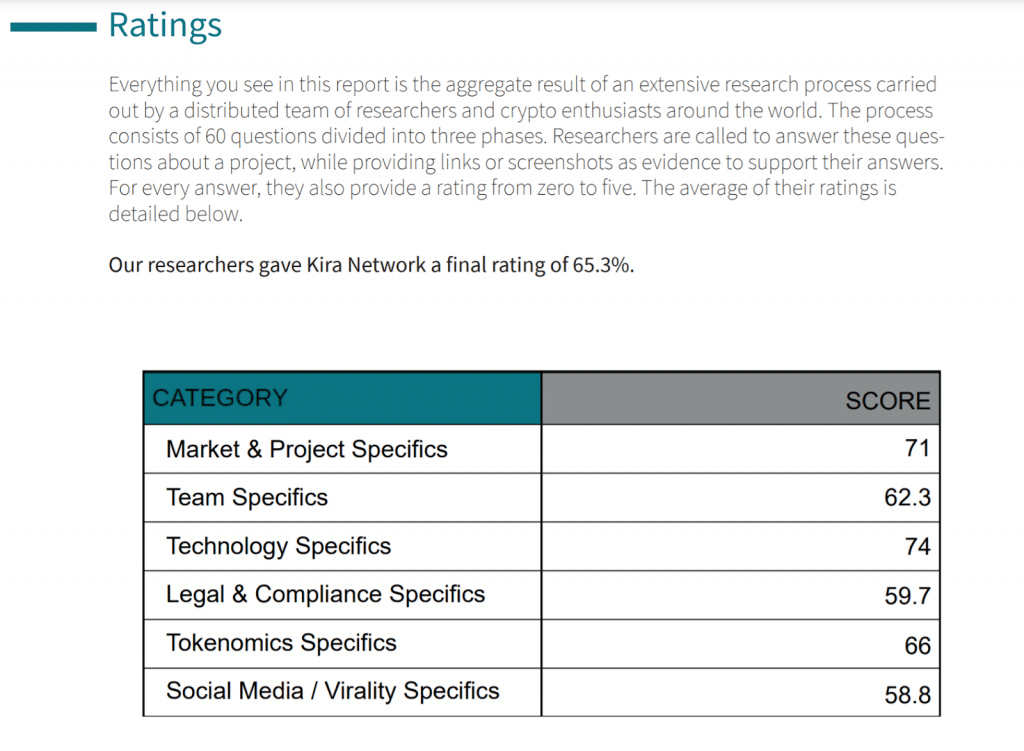

At D-CORE, we’re dedicated to serving builders in the cryptocurrency and blockchain technology space. By putting your project to our Decentralised Objective Research Engine, we provide you with a comprehensive report detailing your strong and weak points. The D-CORE engine comprises 150+ crypto researchers distributed around the globe, following a methodology designed by us along with Ph-D scientists from University College London (UCL).

Broadly, this process looks as follows:

- We recruit capable researchers and empower them, offering a stake in our enterprise’s returns.

- Projects, such as your own, request to be put through our engine to detect strengths, weaknesses, and areas of opportunity.

- Our core team deploys the project to analyse within the D-CORE platform. The platform breaks down the project into several categories, including your team’s strength, social and community presence, fundamentals, technology, products, market fit, and more.

- Every category comprises different questions that a researcher has to address without access to the others’ answers. Researchers are required to provide external sources as proof of the logic behind their answers. In case of unclear/conflicting information, researchers are incentivised to reach out to the project independently for clarification.

- The answers to all the questions are analysed by a committee to determine their validity.

- The above process is repeated until satisfactory conclusions are achieved for all questions.

- Every answer is assigned a quantitative value on a different number of scales. These values get weighted to give the project a quality rating.

- The conclusions are compiled into a concise report.

- You have the option to make your report public or keep it to yourself.

We also provide the D-Core badge of honour for projects that we analyse and meet or surpass our quality standards. These projects also have the option to display this badge on their website and marketing materials. In this case, you can link to your report to showcase that your project went through the engine and received a favourable review.

In case you work with a crypto exchange, fund, family office, or any other kind of institutional investment firm, we also can help you perform your due diligence. With our engine’s reports at your service, it’ll be easier than ever for you to review a high volume of projects, allocating capital to the best ones with ease. In this regard, D-Core can be your key, unbiased personal blockchain advisor.

The current blockchain environment is quickly changing. In this context, D-CORE relieves projects’ urge for feedback in a safe, academic setting, thus giving you a chance to make the most out of your building efforts.

Curious to learn more about D-Core? Click this button to speak with one of our specialists and discover how D-CORE’s research can benefit your blockchain business.