Macro

The US CPI data showed that in February, the CPI increased by 0.4% compared to the 0.5% increase in January. Over the 12 months ending February 2023, the index increased by 6% (before seasonal adjustment). This figure represents the smallest 12-month increase since the period ending September 2021. However, the inflation stays well above the Fed’s long-term target rate of 2%.

In the wake of the panic caused by the collapse of SVB Bank and other developing liquidity issues across the banking sector, the Federal Reserve created the Bank Term Funding Program (BTFP) to make additional funding available to eligible depository institutions to help assure banks can meet the needs of all their depositors. The BTFP offers loans of up to one year in length against high-quality securities, eliminating an institution’s need to sell those securities in times of stress quickly.

Meanwhile, UBS is taking over troubled banking giant Credit Suisse in a corporate action made possible with the support of the Swiss federal government, the Swiss Financial Market Supervisory Authority FINMA, and the Swiss National Bank.

Six major central banks also announced a coordinated action to enhance the provision of liquidity via the standing U.S. dollar liquidity swap line arrangements. The six central banks are The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, and the Swiss National Bank.

The ECB decided to increase interest rates by 0.5 percentage points.

The markets highly anticipate the next FOMC meeting to be held on coming Wednesday.

Networks & Protocols

The Arbitrum Foundation announced the launch of DAO governance for the Arbitrum One and Arbitrum Nova networks and the ARB token. Most (56%) of the tokens are planned to be community-owned, while 12.75% will be Airdropped on 23 March.

Ethereum’s next upgrade, Shapella, expected to hit mainnet on April 12th. The hardfork is expected to take place at slot 6209536.

Euler Finance was hacked this week to the tune of $197 million. According to some public news, the attacker returned some of the stolen funds to Euler. The Euler Foundation announced a $1 million reward for any information that leads to the attacker’s arrest. A post-mortem is available here.

MEV Boost

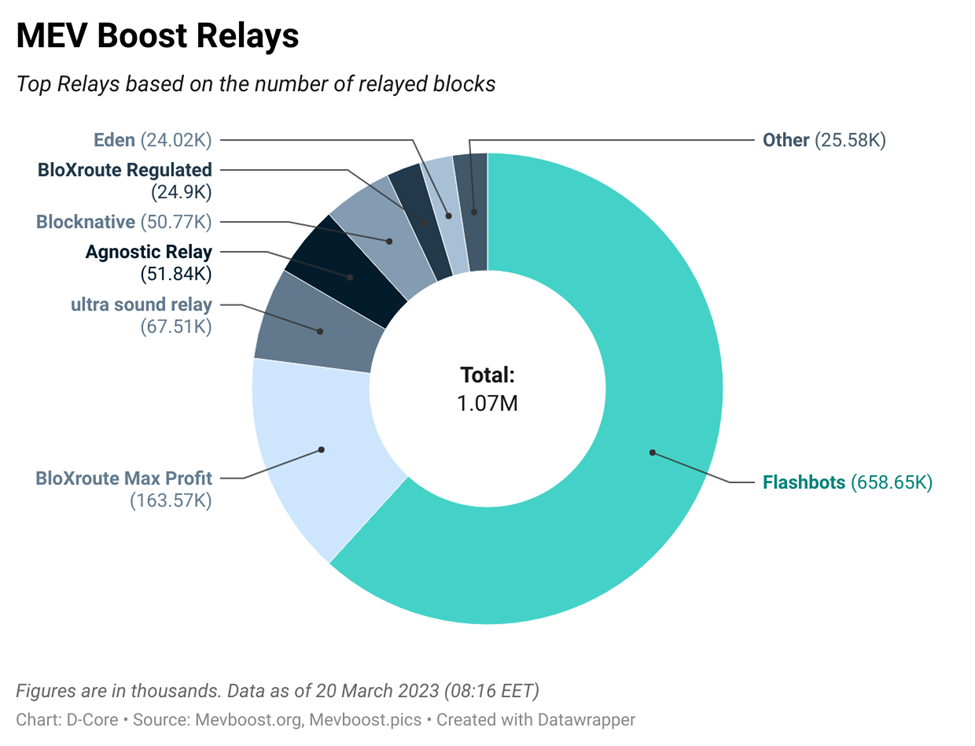

The relay market maintained the status quo by further diversifying relay activity away from Flashbots. Over the week, Flashbots relayed ~27% of the blocks, down from ~34% the previous week. It is also noted that at present, the MEV-Boost slot share has dropped to around 87% while the share of vanilla builders marginally increased.

The Flashbots SGX builder just landed it’s first block on Mainnet. In early March, Falshbots announced successfully running a block builder inside an SGX enclave, and it was live on Ethereum Sepolia Testnet.

The next MEV-Boost Community Call #2 is planned for 30 March 2023.

CeFi

Internal disputes emerged at Defillama, as employees rejected the token plan.

Metaverse & NFTs

Meta paused its development of NFT features for Instagram and Facebook. The company will focus on payment solutions instead.

Microsoft is developing a wallet for its web browser Edge. The new feature is being designed in partnership with Consensys.

Ordinals Update

As projected, the total Ordinals Inscriptions number surpassed the 500k mark during the week. Moreover, the total fees earned from Ordianls exceeded the 100 BTC mark as of the week.

DeGods NFT launched a collection of 535 DeGods NFTs on the Bitcoin Network. Ordinals also went live on the Umbrel App Store. The app allows one to view Ordinal inscriptions using their Bitcoin node trustlessly. The Chief Creative Officer at Yuga Labs discussed some considerations about their work behind the TwelveFold collection.

Regulatory

Blockchain Association submitted Freedom of Information Act (FOIA) requests to the Federal Deposit Insurance Corporation (FDIC), the Board of Governors of the Federal Reserve System, and the Office of the Comptroller of the Currency, requesting documents and communications involving the de-banking of crypto firms in the United States.

The EU parliament approved new legislation on smart contracts and IoT. The new regulations are part of the Data Act.

Europol closed ChipMixer, a dark web crypto mixer, and recovered almost $50 million in Bitcoin.