Macro

- As widely anticipated, the FOMC increased its policy rate by 75 basis points. According to the statement, the Committee anticipated ongoing increases in the target range would be appropriate to bring down inflation to its target of 2% in the long run. However, future rate increases are expected to be lower. The CME FedWatch Tool places a 61.5% probability for a 50 basis points increase in the December meeting.

- Meanwhile, the labor market situation in the US remained relatively stronger. Per the Employment Situation Report for October 2022, the total nonfarm payroll employment increased by 261k. The unemployment rate increased by 0.2% to 3.7%.

Networks & Protocols

- Solend exploited. The attacker drained $1.26 million. Link.

- Ethereum is close to total censorship due to OFAC compliance. Link.

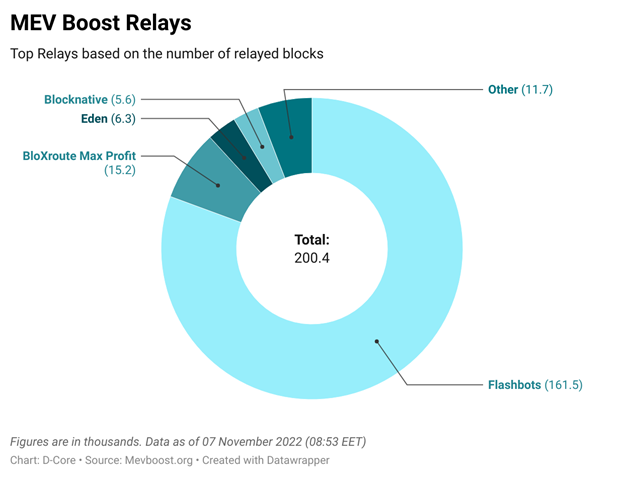

As per the data produced by Mevboost.org, Flashbots continued to dominate the Mev Boost Relays market, with about 81% of the blocks relayed (~131.5k) by it.

CeFi

- UnionBank of the Philippines launched a BTC and ETH trading service, in partnership with a Swiss crypto firm. Link.

- Mariana Project: BIS and multiple central banks to explore CBDCs for trading and settlements. It will initially be composed of the CBDCs of France, Singapore, and Switzerland. The Proof-of-Concept will be delivered by the end of 2023. Link.

- Coinbase released its Q3’22 results with negative growth across several key metrics on a quarter-to-quarter basis. Accordingly, net revenue was $576 million (down 28% compared to Q2’22), and net income was negative $545 million compared to the $1,094 million loss in Q2’22. The data reflects that the trading volume of $159 billion is the lowest reported in four quarters.

- Meanwhile, as per the Q3’22 results posted by Block (who owns Cash App), the company earned $1.762 billion in revenue from Bitcoin.

- Bakkt, a digital asset platform listed on NYSE, announced that it has signed a definitive agreement to acquire Apex Crypto, LLC. The news release reports that Apex Crypto supports clients with a robust solution for execution, clearing, custody, cost basis and tax services facilitating the delivery of frictionless crypto investing in more than 30 tokens.

Venture Activity

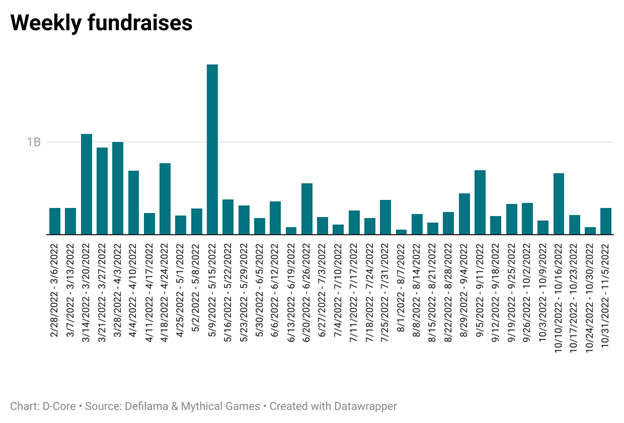

- The weekly fundraising data produced by Defilama (adjusted) shows that the total value raised increased to $286 million week-over-week. There were 18 reported transactions with an average investment value of ~$15.93 million.