Networks & Protocols

While FTX’s collapse and bankruptcy proceedings still make headlines, it’s worthwhile checking what impact the failure caused in the decentralized landscape. In the DAOs space, it is noticed that members were taking measures to safeguard their treasuries from similar shortcomings in the future. Moreover, member decisions may have been influenced by the incidents around the FTX fallout.

- The members of the Decentraland community voted to pause its grants program. Its grants program is an essential part of the Decentraland ecosystem, with a total of $2.6 million contributed since inception in November 2021. A key learning and one of the main reasons for the grants pause is the overexposure of the treasury holdings to one single asset. As per the proposal, Decentraland DAO treasury held 99.1% of its assets in MANA, its native token. The continuation of grants can put selling pressure on MANA and could reduce the available liquidity.

- BitDAO was entangled in the FTX drama due to a swap deal between BitDAO and Alameda Research. According to the proposal, 100 mn BIT tokens were swapped for 3,362,316 FTT tokens, and both parties were supposed to hold the tokens for three years. BitDAO has the FTT tokens to date in its treasury.

- Serum’s, the liquidity hub on Solana, claim to decentralization, came into question as the FTX crisis prompted an emergency fork to avoid a complete disaster. It turned out that the Serum DAO did not control a program update key to the protocol but some unknown person at FTX. Finally, the new Serum Community Fork is managed by a multi-sig controlled by a team of developers. Data shows that the TVL in Serum has dropped to as low as $430k from over $100 million.

- Due to market volatility, AAVE froze the REN, CVX, and BAL markets on its V2 ETH. Currently, there’s an active proposal to make risk parameter updates for AAVE v2 Ethereum Liquidity Pool.

- As FTX unraveled, SafeDAO members voted against a proposal to enable SAFE transferability.

- One of the earliest protocols to get into trouble was the Oxygen Protocol. The project came under heavy criticism from the community as the update was made via Twitter. Although promoted as a decentralized prime brokerage, it has had several points of failure due to centralization. Firstly, a significant portion of its tokens was held by FTX Group. Moreover, ~95% of its ecosystem tokens were custodied with FTX. MAPS faced a similar situation as per the Tweet.

Bitcoin Core v24.0 was made available this week. As per the release notes, this upgrade comes with notable changes, with one of the prominent being the addition of mempoolfullrbf configuration. Learn more about RBF (Replace-by-Fee) here.

Ethereum scaling solutions provider StarkWare open-sourced Cairo 1.0 as a first step toward open-sourcing the StarkNet stack. The current version supports compiling and executing basic native Cairo programs but writing StarkNet contracts is still unsupported.

The Interchain Foundation, a significant contributor to the Cosmos ecosystem’s advancement, announced the formation of a Technical Advisory Board (TAB). Consisting of seven members, the TAB will guide funding and responsible innovation in the Intetchain ecosystem.

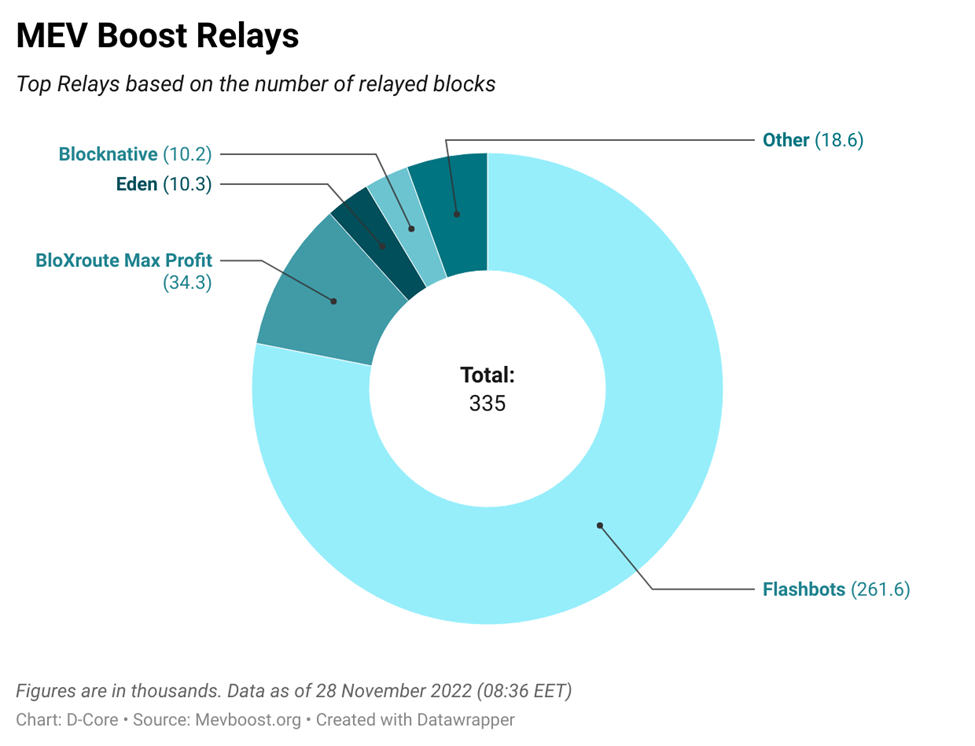

In the Ethereum relayer market, Flashbots continued to dominate the MEV Boost Relays market, with about 78.1% of the blocks relayed (~261.6k) by it. Interestingly, its dominance has declined slowly, as per the weekly stat. The BloXroute Max Profit currently remains the most significant gainer, with a 10.25% market share (four weeks back, its market share was just 6.76%).

CeFi

Norwegian exchange NBX became another player to join the exchanges that have come forward to publish Proof of Reserves.

BofA has partnered with Ripple to provide ODL services after the XRP court case finishes. Link.

J.P. Morgan registered the trademark for its first crypto wallet. Link.

Venture Activity

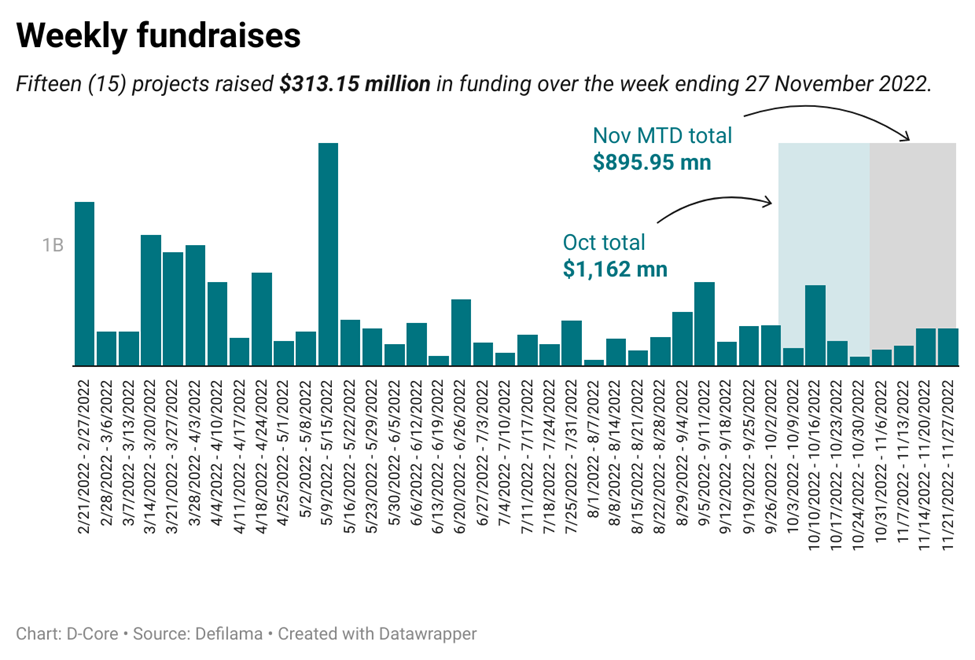

The total weekly value of fundraises remained flat at $313.15 million week-over-week. There were 15 reported transactions with an average investment value of ~$20.8 million. T3rn and Carv, two projects D-Core has published reviews about, raised funding this week. The Month-to-Date (MTD) total funds raised by projects exceeds $895 million.

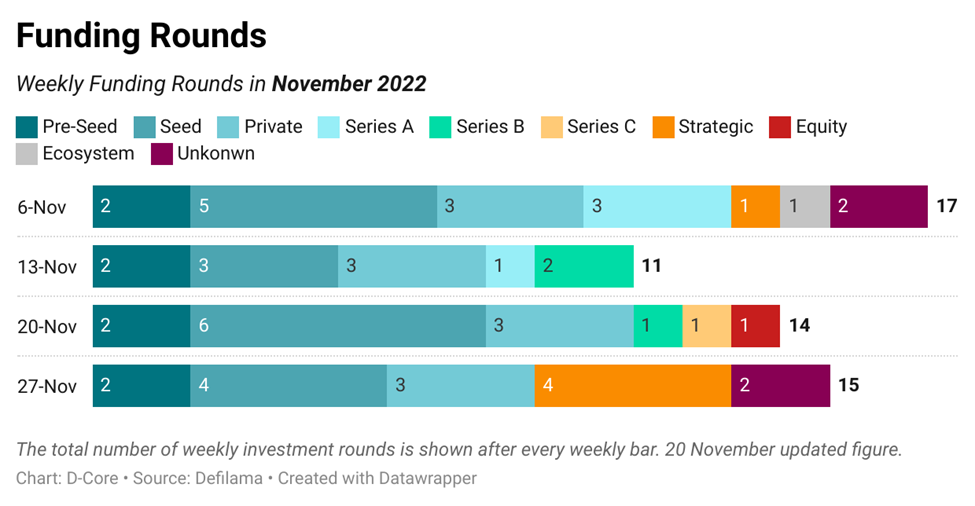

While Pre-seed and Seed rounds continue to account for most rounds, data shows that investors were leading several strategic rounds. The week shows the second-highest number of founding rounds over the last four weeks.

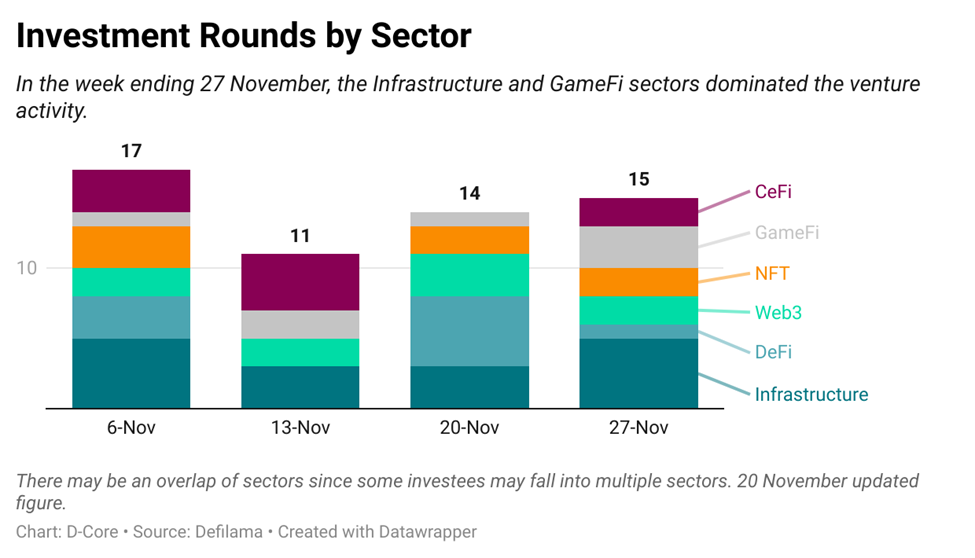

A sector-wise analysis shows that the Infrastructure and GameFi sectors dominate the week.

Regulatory

The Hong Kong Monetary Authority published a paper based on an event study on the Stablecoin Market Crash in May 2022. The paper attempts to study why some stablecoins experienced less redemption pressure than others (out of a sample of 18 stablecoins). The study found that, on average, highly reserve-backed stablecoins suffered less market capitalization decline. The paper highlights the importance of maintaining a sufficient margin of safety as a shield against market shocks.

The NY state governor issued an order banning PoW mining. Link.

The European Parliament passed a vote on EU’s Digital Decade policy program, which includes investing in a cross-border blockchain infrastructure as part of its goals for 2030. Link.