Macro

Last Friday, the Silicon Valley Bank (SVB) news caused a major shift in the macro landscape. The resulting developments rocked the cryptocurrency industry, causing the USDC, the stablecoin, to lose its peg to the US Dollar. However, a Joint Statement from the Department of the Treasury, Federal Reserve, and FDIC allowed USDC to re-stabilize and trade close to the peg again.

Recent events have caused the market to change its expectations regarding the Federal Reserve. Initially, the probabilities were pointing towards a 50 basis points increase. However, with the new developments, there is now a belief that the Fed will only increase rates by 25 basis points instead.

On the 12th, the probability of a 50 bips rise was at its highest, standing above 68%. This shows just how quickly market expectations can change.

Networks & Protocols

Binance.US received regulatory approval to buy bankrupt Voyager digital assets. The deal is worth $1.3 billion.

Hackers attacked the Hedera blockchain. The network was paused to prevent further token thefts from multiple DEXs.

USDC lost its dollar peg after the collapse of Silicon Valley Bank.

MEV Boost

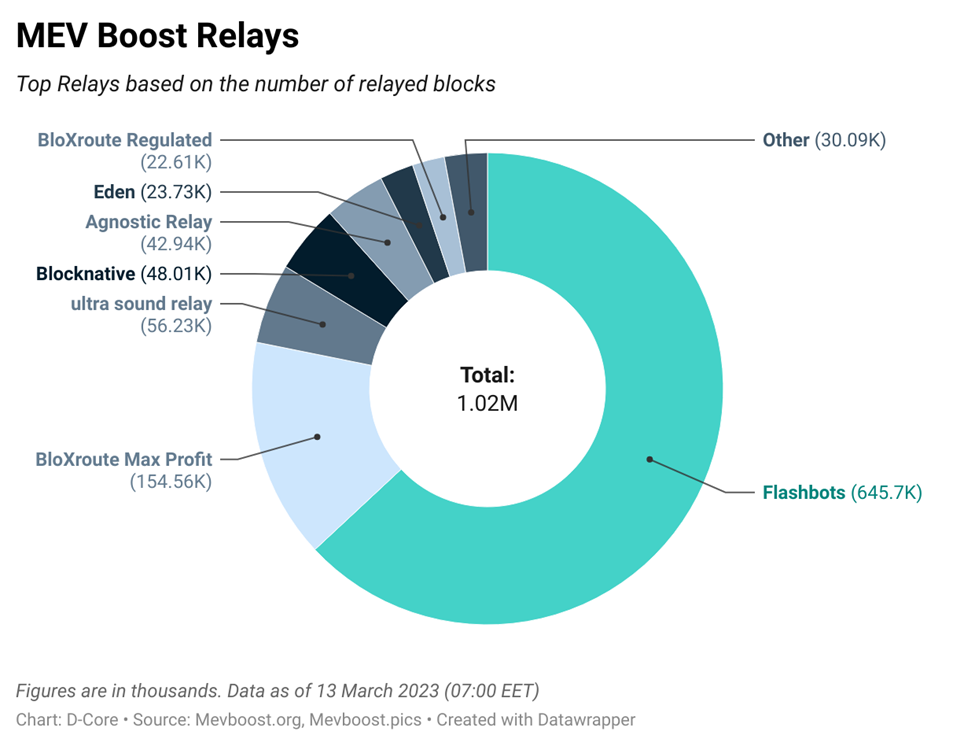

The week of 11 March 2023 saw remarkable changes in terms of MEV-Boost market dynamism and activity. To begin with, the total number of MEV-Boost blocks crossed the 1 million mark since the Merge. Additionally, the MEV-Boost Slot Share surged to 92%, suggesting that more validators had opted for MEV-Boost to boost their income.

Furthermore, the weekly average block rewards from MEV-Boost rose significantly due to the market’s reaction to bank failures. There was also a record amount of MEV-Boost payments made on 11 March, an all-time high for the market.

Finally, a breakdown of the weekly blocks relayed showed that Falshbots accounted for 34% of the relayed blocks (49% the previous week). On the other hand, Ultra Sound Relay and Agnostic Relay had a share of 22% and 19.8%, respectively, with the Relays increasing their market share at the expense of Falshbots and BloXroute (Max Profit).

The upcoming Capella Fork will require changes to the MEV-Boost infrastructure, as outlined in the blog post from Falshbots. This and more information were discussed during the MEV-Boost Community Call #1.

An interesting research discussion around MEV in fixed gas price blockchains can be found here. Another exciting discussion on Cross-domain MEV is taking place at EigenLayer Forum.

CeFi

Kraken is reportedly preparing to launch a crypto bank, the first in the USA.

Silvergate bank announced it would wind down. The news dealt a blow to the crypto market with a decline in BTC and ETH prices.

Swift reported positive results from its pilot test with CBDCs.

Venture Activity

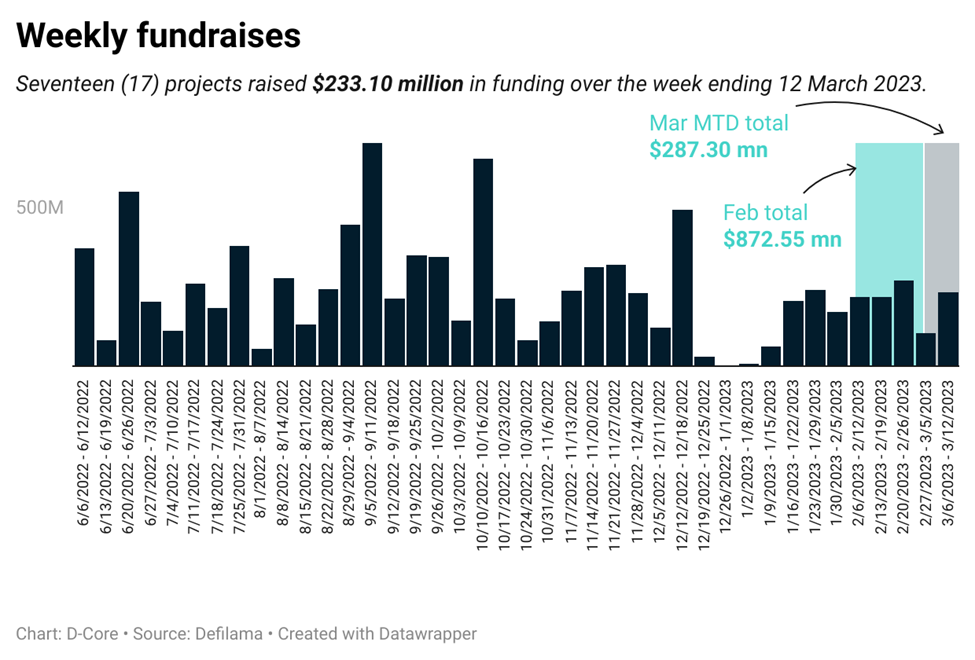

This past week had seen a healthy total of $213.1 million being raised by seventeen different ventures. Notably, the average size of these investments has been larger than in other weeks of the year.

However, about 45% of the funds were raised by Believer and Scroll. Believer is a gaming platform that raised the most significant amount, totaling $55 million, while Scroll secured $50 million in funding for its zkEVM-based zkRollup on Ethereum. Apart from Believer and Scroll, the other investments were fairly spread out. D-Core has released a comprehensive Asset Review Summary. Published on 22 October 2022, this document provides a thorough overview of Scroll.

The month-to-date total for March is $287.3 million, raised by twenty-seven projects.

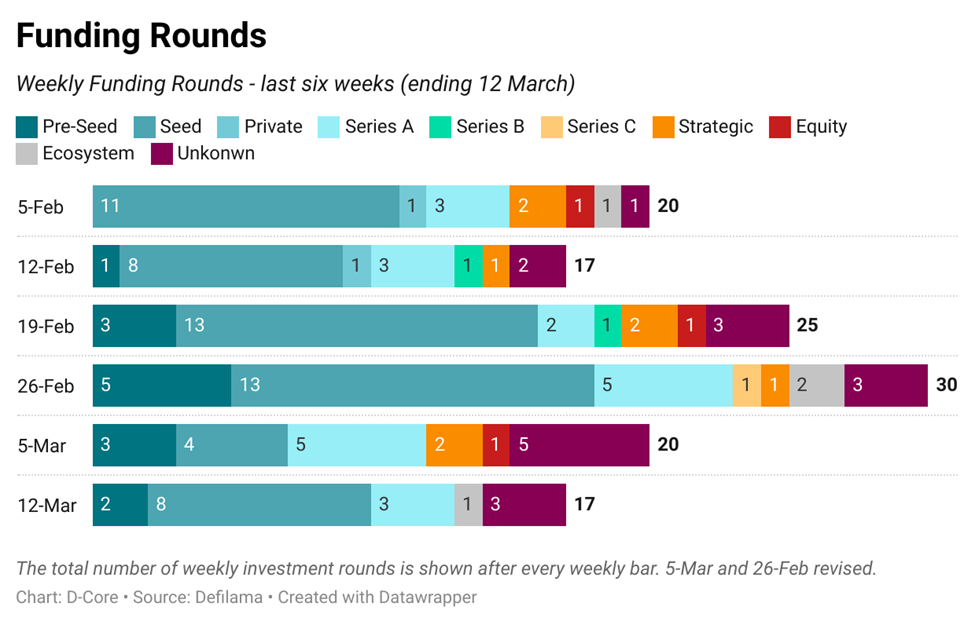

In line with the usual trend, most venture investments during the week were marked by seed raises. One notable exception to this was the Ordinals auction by Yuga Labs, which was a special event.

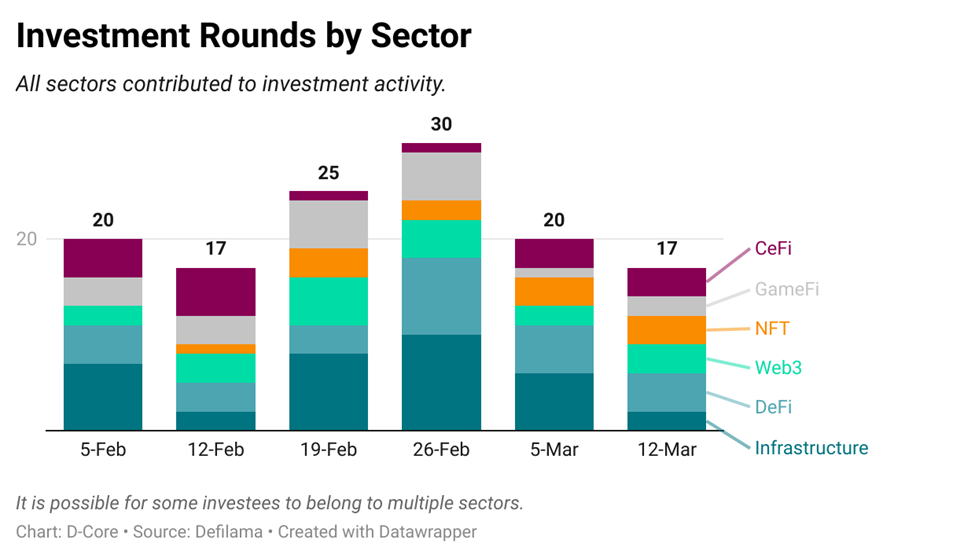

The investors actively engage in all major sectors.

Metaverse & NFTs

The Ordinals, or the BitcoinNFTs, have been receiving an abundance of attention this week. As of now, the total number of Ordinals Inscriptions has surpassed the 400K mark and is projected to break the 500K level by Monday.

Yuga Labs, one of the biggest labs in the space, conducted a successful auction for 288 Inscriptions, raking in a total of $16.5 million. Setting a new record, the 9th saw the highest-ever number of Inscriptions recorded in a single day, with as many as 31,692 Inscriptions. A noteworthy factor in the surge of activity was the BRC-20, an experimental standard that enables the issuance of fungible tokens on the Bitcoin blockchain.

In conclusion, it is clear that the Ordinals NFTs have made remarkable progress this week and are poised to reach new milestones in the coming days.

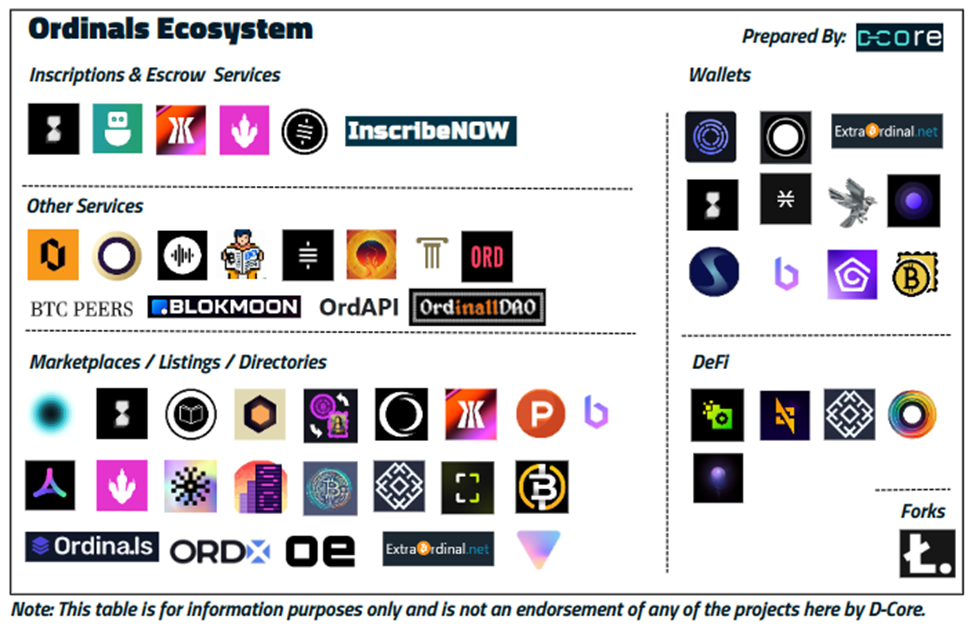

D-Core has published a comprehensive report for anyone interested in learning more about the Ordinals ecosystem. Additionally, we are reproducing the below visual representing the current state of the Ordinals ecosystem which is evolving fast. Further, for up-to-date figures, one can explore Dune Analytic’s dashboard by dgtl_assets.

Regulatory

The Missouri state assembly passed a bill that preserves crypto mining rights.

According to the Wall Street Journal, US President Joe Biden will include Crypto Tax changes in the 2024 budget request.

California regulator closed the Silicon Valley Bank. The Bank London submitted a bid to acquire the SVB’s UK branch.