If you have been following cryptocurrencies during 2020, you know that most conversations revolve around Decentralised Finance (DeFi) products and tokens these days.

And, with DeFi bringing consistent green candles to crypto charts for the first time since summer 2019, a new trend has emerged that promises longer-term gains for investors: Yield farming.

To lend, or not to lend?

If crypto investors are increasingly excited about yield farming, it’s because, to date, it is possible to attain Annual Yields over 100% through multi-platform setups. These setups involve leveraged borrowing and lending through diverse DeFi networks. Yield farmers also take advantage of the tokens distributed by these platforms as rewards, turning them into more capital to increase their lending setups.

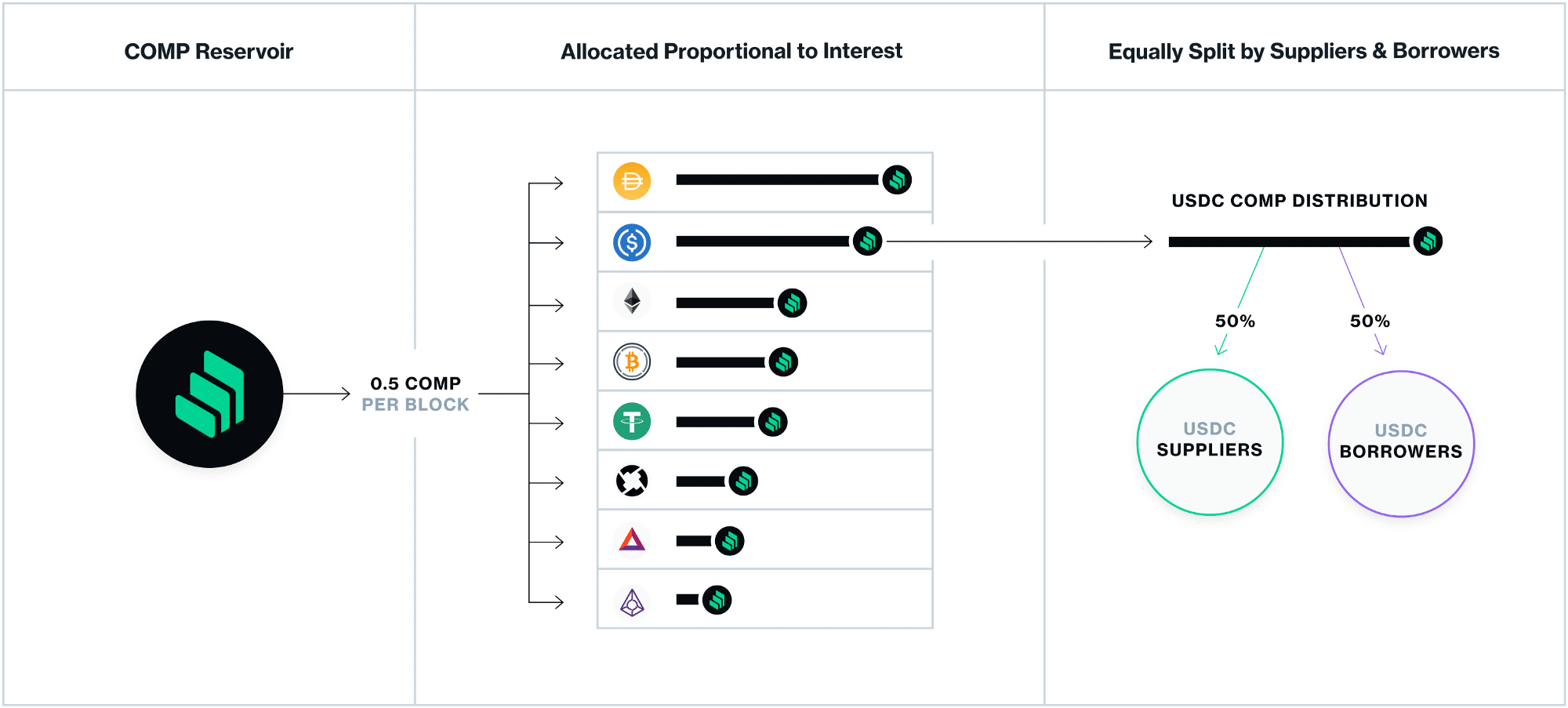

A sample diagram demonstrating a setup to maximise $COMP interest.

One could consider 2020 as the pilot year for Decentralised Finance, a system that hopes to snowball onto completely overtaking traditional finance and replace it with alternatives on the blockchain. Were these systems to sustain themselves in the market without significant interruptions, we could promptly see an exodus that would make the blockchain ecosystem stronger.

However, as experienced players in finance know well, high yields can only mean high hidden risks.

The annual yields attainable through yield farming are as high as they are for a variety of reasons:

- Borrowers are willing to pay high returns to incentive the system since they are getting rewarded with tokens for borrowing. These tokens (the most popular of them being Compound’s $COMP) are currently increasing in value, making them very attractive.

- Lenders receive bonuses as well, making it presently profitable to borrow to lend.

- Working through multiple platforms allows users to leverage each platform’s best features.

- Digital USD pools, such as Curve, enable users to deposit their USD earnings from yield farming to earn rewards for sustaining a stablecoin exchange ecosystem.

Experienced finance players know intuitively that “leveraged” systems based on borrowing can result very dangerous when mishandled. Some of the risks that alert experts in this regard are:

- Direct theft. Although security in crypto and decentralised platforms is theoretically very high and the novelty of blockchain technology makes DeFi platforms inherently vulnerable to exploits. In fact, the hardest critics of DeFi criticise the high number of successful attacks that have occurred in these platforms.

- The enthusiasm for this environment, mostly by inexperienced players, could result in bad practices by well-intended but unsavvy actors, leading mismanagement.

- The complexity and interconnectedness of these platforms make it so that, in case one would fail, the resulting domino effect could affect the whole ecosystem.

- The potential discovering of problems with underlying issues such as lack of liquidity and collateralisation (USDT, for example, has famously refused auditing historically) could result in a complete systematic breakdown.

- Regulations could turn unfriendly towards Decentralised Finance overall.

So, can capital firms benefit from yield farming without directly participating?

Capital firms can cap their potential downside, while still benefiting from the gains of participating in the DeFi system, by investing in the companies facilitating yield farming, rather than engaging in it directly. While there are dangers that come with participating in systems that are continually innovating, hence not fully regulated or stable, diversifying investments across the best players enabling the ecosystem seems to be the best possible strategy.

At D-Core, our target is to help capital firms recognise and empower high-quality industry players through continuous objective, distributed research, using an innovative proprietary system.

We cannot wait for you to join us on this adventure!